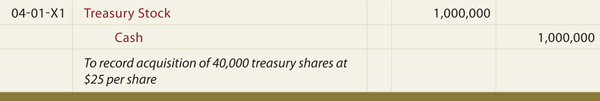

Buyback treasury stock journal entry

Reacquiring Common Stock

Treasury stock is shares of corporate stock that a company previously sold to investors and has since bought back. It may seem strange for a company to do this. A corporation may opt to remove shares from the open marketplace for many reasons.

Treasury Stock | Cost Method | Journal Entries | Example

For example, a corporation may buy back shares of its own stock to prevent a hostile takeover. Fewer shares trading in the open market reduces the chance of another company purchasing a controlling interest in the corporation. Contra accounts carry a balance opposite to the normal account balance.

Equity accounts normally have a credit balance, so a contra equity account weighs in with a debit balance. Your intermediate accounting textbook covers three different treasury stock transactions: All three are pretty easy to journalize after you get the hang of it. Time to get going hanging this treasury stock wallpaper!

The journal entry is to debit treasury stock and credit cash for the purchase price. Sale at more than cost: Sale at less than cost: If the company retires treasury stock, the journal entry is to debit the paid-in capital account that relates to the retired treasury stock and credit treasury stock. Toggle navigation Search Submit.

Find Unclaimed Money, Funds and Property | Never Claimed

Learn Art Center Crafts Education Languages Photography Test Prep. What Is a Limited Liability Company LLC?

Knowing Your Debits from Your Credits. What is Double-Entry Bookkeeping? Accounting and the Theory of Financial Reporting.

Related Book Intermediate Accounting For Dummies.