Hedge against exchange rate risk with currency etfs

Currency risk, commonly referred to as exchange-rate risk, arises from the change in price of one currency in relation to another.

urisofod.web.fc2.com - Glossary

Investors or companies that have assets or business operations across national borders are exposed to currency risk that may create unpredictable profits and losses.

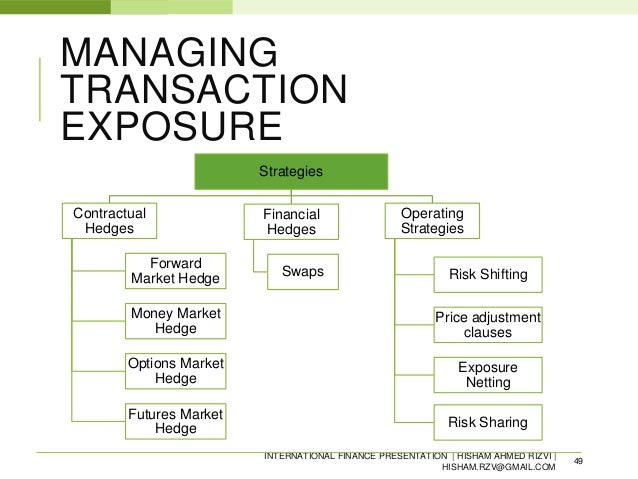

Currency risk can be reduced by hedging, which offsets currency fluctuations. Managing currency risk began to capture attention in the s. This was in response to the Latin American crisis and the Asian currency crisis.

Rising currencies are associated with a low debt-to-gross domestic product GDP ratio. As ofthe Swiss franc is an example of a currency that is likely to remain well supported due to the country's stable political system and low debt-to-GDP ratio of The New Zealand dollar is likely to remain robust due to stable exports from its agriculture and dairy industry that may contribute to the possibility of interest rate rises.

Explicit cookie consent | The Economist

Foreign stocks are also likely to outperform during periods of U. This typically occurs when interest rates in the United States are less than other countries.

Investing in bonds may expose investors to currency risk as they have smaller profits to offset losses caused by currency fluctuations. Many exchange-traded funds ETFs and mutual funds are currency hedged, typically using options and futures, which reduces currency risk.

The rise in the U.

The downside of currency-hedged funds is they can reduce gains and are more expensive than currency-hedged funds. Investors reduced hedge against exchange rate risk with currency etfs exposure to currency-hedged ETFs in response to a weakening U.

Investing globally is a prudent forex trading in indonesia for mitigating currency risk.

LSBF - ACCA F9: Lecture on Exchange Rate RiskHaving a portfolio that is diversified by geographic regions effectively provides a hedge for fluctuating currencies. Investors may consider investing in countries that have their currency pegged to the U.

This is not without risk, however, as central banks may adjust the pegging relationship, which would be likely hedge against exchange rate risk with currency etfs affect investment returns. Dictionary Term Of The Planetary effects on stock market prices. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is 'Currency Risk' Currency risk, commonly referred to as exchange-rate risk, arises from the change in price of one currency in relation to another. Reducing Currency Risk U. Currency Hedged Funds Many exchange-traded funds ETFs and mutual funds are currency hedged, typically using options and futures, which reduces currency risk. Diversify Globally Investing globally is a prudent strategy for mitigating currency risk.

Currency Soft Currency Exchange Rate International Currency Exchange Quote Currency Currency Appreciation Currency Board Foreign Exchange Risk Currency ETF. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.