Startup stock buyback

Clawbacks for Startup Stock - Can I Keep What I think I Own? STOCK OPTION COUNSEL

By Nicole Gravagna, Peter K. All successful venture-backed companies have an exit.

Stock buybacks are one option for the end — the time when you no longer own your start-up anymore. Ideally, you should plan your exit well in advance. In a stock buyback, the company buys stock back from the angel or VC investors.

Vesting and buyback rights - Dentons ventureBeyond : Dentons ventureBeyond

When a stock buyback is your exit strategy, VCs usually look for the purchasing company themselves. Entrepreneurs who think they can buy the stock back in the future are typically inexperienced and unrealistic in their expectations.

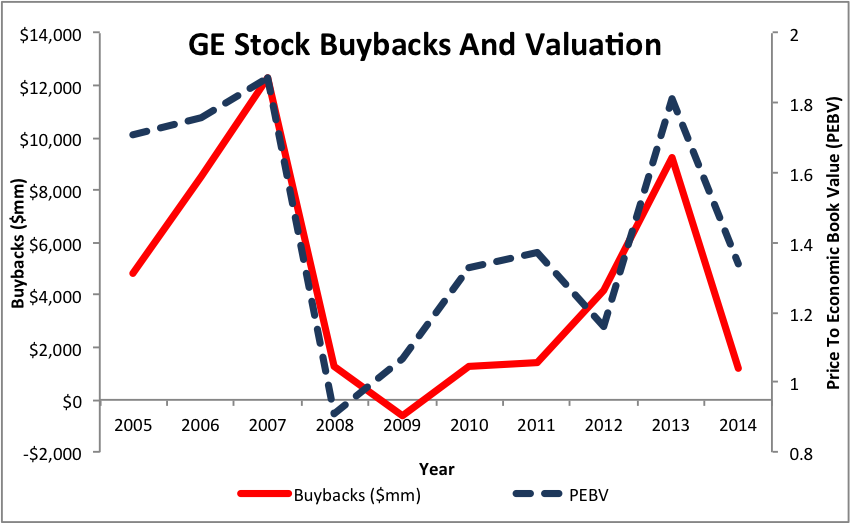

Publicly traded companies may have many reasons to pursue a share repurchase: In most of these cases, unless a leveraged buyout is involved, stock buybacks are partial repurchases of shares. Even big public companies cannot afford to buy back all of the outstanding shares.

Your smaller nonpublic company is not likely to have the resources to make a complete buyout, and VCs are not going to be interested in a piecemeal buyout. If the potential return absolutely cannot go higher than 2X or even 10X, the deal will just not be interesting to them.

Toggle navigation Search Submit. Learn Art Center Crafts Education Languages Photography Test Prep. RELATED ARTICLES Stock Buybacks for Venture Companies.

Venture Capital For Dummies Cheat Sheet. Finding a Qualified Securities Attorney for Your Venture Capital Deal. Stock Buybacks for Venture Companies. Related Book Venture Capital For Dummies.