Risk calculator forex trading

The secret to good Forex trading is to use sound judgement and analysis of the currencies you wish to trade on and prepare yourself in case your chosen trade loses. This article will teach you basics of prolonging your trading capabilities.

When it comes to trading, there is one major difference between a beginner and a professional trader:. A new trader concentrates on how much money he can make, while an experienced one focuses on how much money he can lose. Now think of that for a moment.

Risk Calculator for MetaTrader, Account Risk in MT4/MT5

It may seem like the new trader is optimistic and the professional is a pessimist, but that is not the case. One of the traits traders acquire over time is learning how to lose gracefully. The truth behind investing is that stumbling across losing trades is inevitable. However, properly managing your risks is vital for long-term success.

Position Size Calculator | Myfxbook

Forex risk management is all about knowing and limiting the risks in forex trading. Such a technique activates at a given price level that assures a trader that he will make a predetermined profit or loss.

Forex Risk Calculator | Winners Edge Trading

So, before you enter a trade, you should make an exit plan. However, if the market continues to move against, some novices will insist on holding on to a trade, desperately hoping that it will go back up for the sake of recouping their losses. As their emotions ensue, they now have taken bigger losses than they can cope with. Now, trading for them has become a total nightmare or what is termed as a margin call.

Through lack of planning and emotional takeovers, you are putting yourself at high risk. Instead, you should make choices based on sound analysis rather than the need to get out of a trade.

On the other hand, traders have exited trades they thought have bottomed out, only to find the market moves back up.

Forex Trade Position Size Calculator » Learn To Trade

Anyway, those who decide not to let this happen to them again become better traders. We can look at risk through probability. We then are break-even traders. To be profitable, one of two things must happen:. Any successful trader knows that there is no one trade that is guaranteed to be a winner.

The pros treat trading as a business rather than a form of entertainment. PIP is an acronym for percentage in point meaning the smallest price change that a given exchange rate can make. As currencies are quoted, they are quoted to the full decimal place. For instance, take the following quote: The very first question that comes to mind may be: How many lots should we open?

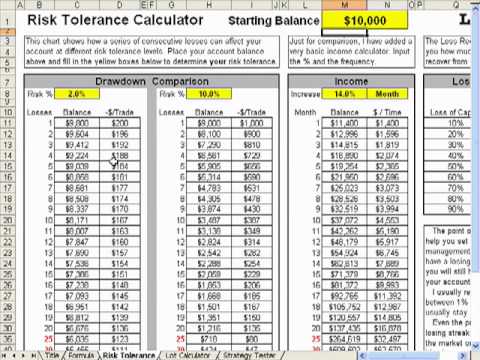

Click Here to use our pip value calculator. With a risk ratio this high, we can run out of money before winning another trade. Therefore, we want to risk a limited number of pips and a limited amount of our account balance so we can continue to trading even after a few losses.

To get a better feel for calculating our trade size, we can carry out some simple calculations:. Determine the pip cost of your trade. Now if we purchased 2 lots, our pip cost would double: How about 3 lots?

So in this scenario, it would be best to buy 0. Basic trading money management requires:. Remember, patience and consistency are key virtues. One good trading opportunity now can lead to more in the future.

To have more winning trades, you have to learn and master a good and strong trading system , that not only help you locate the best trading opportunities, but also shows you the best possible place to set the stop loss orders to limit your risks. Here is also some of the articles that help you in your money management plan. Very good explainations once again. Do you have a page set up where we can follow the facebook contest that we started? I have to ask my web developer friend to check, because he launched the contest and he knows what to do.

I am not good in these things. Hi Chris Thanks again for a great article. It was my error again. Hi chris, as regards the facebook contest, i hope you are monitoring our performances? Would you gauge it as a strong setup when coupled with a Butterfly?

Let me help Chris a little. It requires at least 2 more candles with long shadows to be considered as High Wave. Hi Chris, usdcad formed a strong bearish engulfing on daily.

Is there any sign that bullish trend has weakened. Do you think EURUSD would be worth analyzing? Lately it seems a reversal is trying to happen. Piercing Line on 6th Oct. Hammer on 3rd Nov out of Bollinger Band. It is too bearish. We have to wait for bears to become exhausted.

What you mentioned makes a lot of sense. These two pairs are strongly correlated. However, none of them can be rated as score setups. This is what i saw that made me trade this setup perhaps i understood the rules of the DBB system wrong.

It is not the typical setup. Please read the DBB article one more time and see the examples. I was completely ignoring the middle band which made the setup more loose. I need to wait for those strong setups using the middle band. Tho in the DBB article after reading says: We only use it to hold the positions to maximize our profit, but it has no role in forming the trade setups and taking the positions.

Yes, it has no role but in a short trade setup candlesticks 1 and 2 can not close anywhere, even close to BB1 upper band. They have to close somewhere close to BB lower band but not below it. After confirmation we can go long. In monthly timeframe it reached to BLB.

In daily timeframe its not worth to go long after breakout support level. It may test broken level and go down. I look forward your analyses.

Have a nice weekend! Hello, Iam reading all your posts and they are very interesting.

I started learning forex, three weeks ago reading most articles and notes on your site: What do you think? This week, i started testing demo account, i got 4 of 6 good trades.

I am very fearful when i have an order. I close my order when i start winning: You are at the beginning of the way and you have to spend some time to learn and practice. If you learn to locate the strong trade setups, take your positions, set the stop loss and targets, then there is no point to have fear or greed or any other emotions.

For me, the best pair to trade is the one that has formed a too strong trade setup on the chart. We trade the trade setups, not the rumours. So i wanna ask you that. When we take too strong setup,can we move stop loss of both trade setup to breakeven when price move in our favour 2x riskier TP, cuz the price often when its going to hit our stop loss reverse at 2x TP OR GO much further in strong setup direction, look at the charts and you will see what i am talking about.

Sorry for long post I hope you will get what I mean and I wanna your opinion. Yes, we can do that to trade more conservatively.

Many traders move their stop loss to breakeven even earlier. So I would place 2 or 3 in the box as not to get NaN just for clarification.

Thank you for following up. Leave a Reply Cancel reply:. Your email address will not be published. Notify me of followup comments via e-mail. You can also subscribe without commenting. Get Our New E-Books For Free. Forex Risk Management and Position Size Calculation By: Money Management Last Updated: Enter Your Email Address and Check Your Inbox: LEARN A PROVEN BUSINESS PLAN. November 7, at November 7, at 1: November 8, at November 7, at 4: November 7, at 5: November 7, at 6: November 7, at 7: November 7, at 8: November 8, at 4: November 8, at 1: November 8, at 2: November 9, at 1: November 9, at 4: November 8, at 8: November 8, at 9: March 16, at 4: March 17, at March 17, at 4: July 21, at 3: July 21, at 4: July 22, at 1: September 9, at 4: October 20, at 5: October 20, at Leave a Reply Cancel reply: The Easiest Way to Get Rich Fast.

Learn How to Get a Job with Mississippi Department of Employment Security Reaching What You Want without Doing Anything Candlesticks or Support and Resistance Levels?

Making Excuses Is the Only Thing Some People Do How to Write a Business Proposal for the Business You Want to Start Recent Comments LuckScout on What Is Data Technology and How It Can Make You a Millionaire? Joseph Kolade on What Is Data Technology and How It Can Make You a Millionaire?

LuckScout on What Is Data Technology and How It Can Make You a Millionaire? Abata Moses on What Is Data Technology and How It Can Make You a Millionaire?

Success Business Blogging Trading Investment. Home LuckScout Mementos Contact About Archive Privacy Policy Terms. This Is More Important Than the Article You Are Reading:. Are You Enjoying Our Site?

Our eBook Is Even More Important!