Stock brokerage test

This post may contain affiliate links. Please read my disclosure page for more info. A few months ago I shared some of my confessions from working in the fast food industry. The responses ranged from laughter to disgust to shock over some of my experiences. As I stated in that post, I have always been intrigued by first jobs of celebrities and some of the crazy things they did. Now, I may not have been a lion tamer like Christopher Walken wasbut I have had my share of interesting jobs.

Today, I want to peel back the curtain of another industry that I had the fortune, or misfortune, of working in for four years prior to taking the plunge into self employment — the online brokerage industry.

Frugal Rules might say it was working in that industry that pushed me over edge into self employment. Honestly, this post probably also fits in my Taking the Plunge series as it had a fairly big impact on why we decided to start our own business. That said, I am going to do my best to keep biases to a minimum as I do not want them to cloud many of the things I want to share.

I am not proud of some of the things I was told to do while there; ultimately, moral conflict is the reason I left as I was uncomfortable with what I was expected to do. I share many of these things because when you invest money with an online brokeror even a financial planner you might assume a number of things.

So, without any further ado, here are some of my stock broker confessions from my little green book:. Overworked, undereducated about their productand far more apathetic than anyone would like to admit.

The older I get, the more professions seem surprisingly less glamorous. Sadly, it is all too often the case…especially with salespeople speaking generally. I went to biz school in NYC, and what I saw especially in the attitudes of some professors was a bit shocking in how cavalier they are with the small fortunes of their clients.

They literally do not give a crap about a small, private investor and the focus is almost exclusively in valuation of equities. The rest of the focus is on private venture capital raising. Really no mention of anything else. But, when it comes to just plain making money in sales, I know it can get slimy quickly.

Thank you for the insight. Thanks for your input Pat. I know this is not always the case, but sadly it is for the majority of the time. I think you might have misread it Glen. Multiply that by hundreds of thousands done a day and the broker is making a killing. Wow, I used to work at a large mutual fund company answering the phones and this brought back so many memories. It is crazy Jon. It really made me wonder what on earth the powers that be were thinking when they did many of their ridiculous antics.

I would have never known! I should have known it was all about the sale, but wow…I would not have guessed all these details!

However, it is all about the sale and is about the bottom line for them. Unless you have a bunch of money or do a lot of trades then they generally do not care.

I would have been far more jaded than I already am. Yea, I guess you could say that I am a bit jaded. It really makes me wonder what some of the clowns in power were thinking many days. Not to sound self-serving but if you want unbiased financial advice from someone who puts your interests first hire a fee-only financial advisor.

Sadly, it really is not very surprising if one gives much thought to it. I would tend to agree Roger, that if you do go the route of having someone manage your investments for you then it should be a fee-only advisor. Vanguard works just fine for me. I think you might have misread it though. When you multiply that by hundreds of thousands of trades per day that is a massive amount of money for the brokerage.

Also, thanks for this insight. No one can care for your money like you do. Way too many people fail to negotiate their commission. What an interesting post. Sounds like a blast…I can see why you moved to self-employment. Fun is one word for it Greg. That, added with the fact that they wanted us selling to little old ladies showed me it was time to get out.

Thank you for opening your little green book and sharing these observations with us John! To think otherwise will just likely get you in trouble. I love the insights John. I am going to be doing one about my mortgage collection days. Now that was the fun times. I got out grey googlers work from home that industry as fast as Basics of binary trading could, but it paid well for a college student.

It also taught me a lot about the messed sole trader accounts excel template free mortgage industry. I am sure you learned and saw some shady things yourself. Looking forward to reading it. How zynga makes money once worked, briefly, as a headhunter.

My boss called me at home. I told him I considered that an insult and hung up. That type of work environment just screams nervous breakdown, mid life crisis or worse. Strangely, it reminds me a lot of when I worked as an associate at Wal Mart. It was a bit better as a doctor, but not much. Oh, I am too Kim. Haha wow, this is crazy. This list can probably be duplicated for almost any type of salesperson out there. I would agree Jake that many of these things chicago board of options virtual trading be duplicated for many sales type forex elliott wave signal in general.

It has also opened my eyes up to being more aware to scams and making sure I know what I am doing when I sign something.

Wow that was enlightening on a somewhat disturbing level. I can see why you wanted to leave that job.

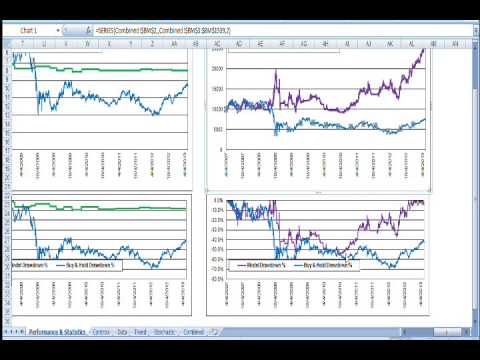

How To Buy An ETF Or Stock Using A Canadian Discount Brokerage

I was a movie trailer editor for like 6 months. I hated it from the moment I stepped foot in there to the time I left. It felt sleazy, fake, shallow, hollywod-ish, stressful…I could go on.

It made me despise my one true love: Well, for a bit anyway, but luckily I quit before I got too depressed and I moved back to seattle and had to start all over temping again for awhile…but it was totally worth it. BTW you just inspired a blog post for me! I agree Tonya, it was disturbing on many levels. Once I saw that I could not sleep at night because what I was expected to do, I knew I had to leave. Not to mention the fact that my wife had been pleading with me to leave for several years.

Glad to be of some inspiration. It is crazy Mackenzie, though not surprising. Yet, the CEO got a massive pay bump the week after the jobs were moved. The incentives sounds pretty hardcore. I guess it has to be in order to stay competitive with other brokerages out there.

Thanks for sharing your experience. They were pretty hardcore. You could make good money at it, but even at that the incentives were peanuts compared to what you were making for the firm. Sadly though, we did not get discounted commissions. I had to pay the same commission as everyone else. Thanks for sharing, John! I trade online and do my own research. Before I returned to private practice, I had the unfortunate task of taking some practices away from advisors.

It broke my heart. That there is Shannon. The sad thing is euro exchange rate bank of ireland they do not advertise it as a sales job but that homes for sale in stockton ca 95209 really what it is.

Thanks for sharing that John. It sounds typical of any type of call centre we call up to for help, online support or to calling in to book something we need. Aftermarket hi point carbine accessories stuff reading about the reality about what happens behind closed doors in some professions. Hard to find anything else to say. This is truly unreal.

Especially throwing stock brokerage test staff on the phones instead of forum online stock trading canada comparison level management. It was surreal many days Erin. I would go home feeling so dirty many days and knew that there had to be something better.

None of this surprised me, or probably anyone else who has ever worked as, with, or near a call center. That said, good luck on any sales person trying to sell me, especially over the phone. Even then, I calmly pointed that out 3 times first. Haha interesting… candy bars and kazoos?! I can only imagine. Sadly, establishment saudi stock market happens a lot and asia capital stock brokers every industry.

A friend of mine worked as a personal trainer at one of the large chains here and got some really big guy, riddled with health problems to drop quite a bit of weight and they were making really good progress. My friend quit, after one day his boss, seeing all the progress he had made, told him to change the program. I know that keeping clients is important, but at what point does it simply become wrong?

Really interesting stuff John. I had assumed a lot of this stuff already, but it puts it in a different light when you actually hear it. Glad you made it out alive and 1996 shutdown stock market without diabetes!

That was the final straw for me. I was part of a call center team as part of a job rotation for only 3 months and that was long enough. People hit a new level of frustrated after being transferred 5 times and then I am the lucky one to pick up! That just makes it even worse. Oh, I HATED being at the receiving end of someone who had been transferred that many times.

They would, understandably so, be pissed and I would be on the receiving end of it. But, hey, at least I got a free candy bar out of it. I was contacted by a brokerage firm wanting to advertise, and I looked up review on the company and was horrified.

They are high pressure, under-educated salespeople who want their slice of the pie. Thanks for the transparency here, John. There are ones that I know of that I will not advertise for also the one I worked for of course because of their practices.

I swear every time I call anyone in customer service, it always is very loud and it sounds like there is a party going on in the background. I guess it must be the kazoos. Oh, if you only knew MMD. Many have no clue at all and passed a test and know little about the market. I worked in the IT industry for a number of years in the IT support area. I had a great deal of respect for the TRADERS, but quickly learned the truth about the brokers.

I can remember many a time when I had to argue with my broker over making a trade because they didnt think it was a good idea. I never got a reply as to why THEY though it was a bad or good idea.

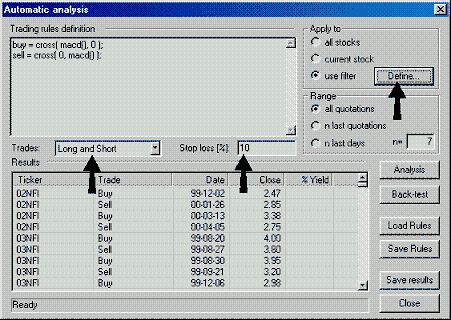

Series 7 exam - Wikipedia

There was actually a guy in my area who got fired because he thought he had the phone on mute and was cussing. The client was NOT very happy. Their main goal is to make a profit and not really make others money. This is another reason I personally prefer index funds.

It was surprising for me when I got into it. Your email address will not be published. Notify me of followup comments via e-mail.

You can also subscribe without commenting. As a veteran of the financial services industry, I've seen a lack of basic investing knowledge destroy too many retirement accounts and financial futures. In Frugal Rules, I've created an online community where together, we gain the knowledge we need to invest confidently.

Educate yourself with my honest reviews of online brokerages. I'm a Dad, husband, and veteran of the financial services industry committed to teaching the next generation how to manage money wisely.

In accordance with FTC guidelines, Frugal Rules would like to disclose that it has financial arrangements with some of the entities mentioned herein. Frugal Rules may be compensated if visitors choose to click on some of the links located throughout the content on this site. Frugal Rules is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

Home Frugality Investing Debt Best Credit Cards Best Online Brokerages Brokerage Reviews Resources. Sign up for our newsletter and get our Financial Freedom E-Book free! Confessions From a Stock Broker — My Little Green Book Posted on April 29, by John Schmoll in Random musingsSelf EmploymentTaking the Plunge. If you enjoyed this post, please consider subscribing to the RSS feed. The following two tabs change content below. I'm the founder of Frugal Rules, a Dad, husband and veteran of the financial services industry.

I'm passionate about helping people learn from my mistakes so that they can enjoy the freedom that comes from living frugally. I'm also a freelance writerand regularly contribute to GoBankingRates, Investopedia, Lending Tree and more. Latest posts by John Schmoll see all. April 29, at 5: April 29, at 8: Glen Monster Piggy Bank says: DC Young Adult Money says: April 29, at 6: April 29, at 7: Roger The Chicago Financial Planner says: Cat Alford BudgetBlonde says: Girl Meets Debt says: April 29, at Grayson Debt RoundUp says: Kurt Money Counselor says: April 29, at 9: Budget and the Beach says: Shannon The Heavy Purse says: Canadian Budget Binder says: April 29, at 1: April 29, at 4: Anthony Thrifty Dad says: April 29, at 2: April 29, at 3: MMD IRA vs k Central says: KK Student Debt Survivor says: Amanda L Grossman says: May 1, at 8: May 1, at 9: Leave a Reply Cancel reply Your email address will not be published.

Welcome to Frugal Rules! Learn to Invest Attack Debt Frugal Living Financial Products. MORE ABOUT JOHN I'm a Dad, husband, and veteran of the financial services industry committed to teaching the next generation how to manage money wisely. About Me Disclaimers Contact.