Buying spy call options

The last few years have seen rapid growth in the variety of investment vehicles available to the retail investor.

It often seems that the average retail investor is inundated beyond their ability to act. K eep I t S imple S tupid is out of style. My articles have put forth various option strategies that run from very simplistic to extraordinarily complex.

In an attempt to make them easier to follow I always start with a premise. That is, what is it that the investor trying to accomplish?

Buying Calls Option Strategy

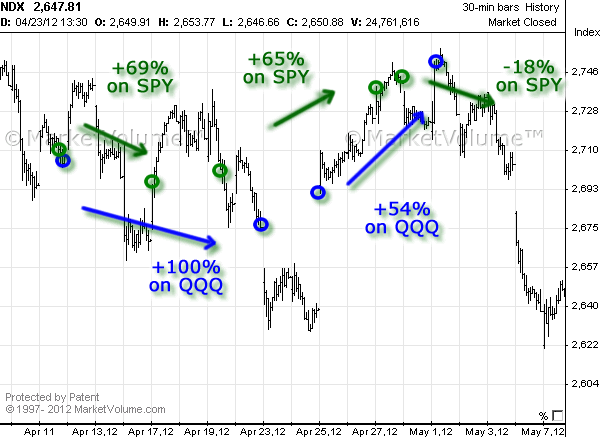

Investors are hungry for better ways to invest. They seek out better alternatives to "buy and hold". SPY it would seem that alternatives to SPY would meet with lots of interest. Is it better to own SPY outright or sell cash secured Puts? Under existing law, SPY and its dividends can benefit from favorable tax rates.

Put sales, on the other hand, are considered ordinary income and denied this favorable tax treatment.

In a taxable account, this factor alone tips the scale in favor of owning the stock. If the investment account is not taxable such as an IRA then a comparison of the two strategies can yield worthwhile results. Clearly selling puts does not have the same level of flexibility that accompanies direct buying spy call options ownership. Once again, this tips in favor of direct stock ownership.

SPDR S&P 500 ETF (SPY) Technical Analysis Massive Call Buying Options Bought S&P 500 "SPY" $2.1BSelling puts credits the investor with a premium in exchange for taking risk if the underlying stock moves down. Part of the analysis is intuitive.

If SPY moves up sharply, the maximum gain the put seller can realize is the premium credit admiral markets review forex peace army. In contrast the stock owner has unlimited upside. If SPY moves down, the Put Seller softens the loss by the amount of premium credited while the stock owner suffers the whole loss.

But what happens over a long term of many months or even many years?

What about the BUY and What is stock broking industry of SPY? Luckily, the CBOE has already done all the work. I urge you to go to their web-site and read more www. All that is needed is to compare this hypothetical index to a real world stock.

But both represent down-trending markets. In the months that SPY rose dramatically it outperformed the PUT Index.

Average Annual Return Standard Deviation. The outsized returns of the PUT Index buying spy call options jumps out from this table. But it is the standard deviation that provides the most insight. Standard deviation is one of the metrics used to calculate risk. The lower the standard deviation, the lower the risk.

This alone would be enough for me to sell put options over owning the SPY outright.

Selling WEEKLY puts on SPY should bring even better results. The effective cumulative premium received is greater and market swings are less exaggerated.

In conclusion, selling weekly puts on SPY, slightly above the money, may turn out to be a preferable to actiually buying the shares. This strategy would appear to provide greater returns with lower risk.

A hard combination to ignore. Even more so when the market is flat, downward or modestly upward.

How I Successfully Trade Weekly Options for Income

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. ETF Screener ETF Analysis ETF Guide Mutual Funds Closed End Funds Editor's Picks. Buy And Hold SPY Vs. Selling SPY Put Options Oct. Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Reel Ken and get email alerts.