Selling a stock on the ex-dividend date

Buying or selling a stock around the dividend dates can be confusing.

Can you receive a dividend on a stock you already sold? - urisofod.web.fc2.com

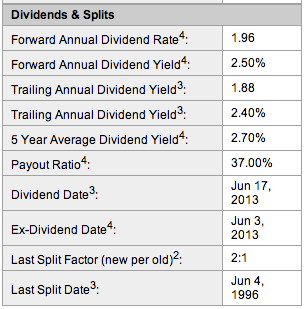

For each dividend payment there is an ex-dividend date, a record date and a payment date. To insure the receipt of a pending dividend from a stock you own, the ex-dividend date is the most important of the three to understand.

To receive a dividend payment, an investor must own the shares on the declared record date. A company will include the record date with each dividend announcement along with the amount of the dividend.

To officially own stock shares on a specific date, the order to buy the shares must have been placed at least three business days earlier. Stock trades in the U. Due to the three day settlement rule, a stock goes ex-dividend two business days before the record date.

If the stock shares are purchased no later than the day before the ex-dividend date and held until trading starts on the ex-dividend date, the investor will receive the dividend payment.

The stock can be sold any time after the market opens on the ex-dividend day and the dividend will still be deposited in the investor's account on the dividend payment date. On the ex-dividend date, the share price of the stock will start trading at the previous day closing price minus the amount of the dividend.

This price change prevents a trader from profitably buying shares just before a stock goes ex-dividend and then selling on the ex-dividend date with a plan to profit from the dividend received.

Selling shares on the ex-dividend date defeats the purpose of earning the dividend. The value of the stock drops on the ex-dividend date by the same amount as will be earned when the dividend is paid. To collect a dividend from a short term stock investment, the shares must be held until the share price recovers to at least the value on the day before the ex-dividend date.

Dividend dates explained | interactive investor

Can I Sell on the Ex-Dividend Date and Get the Dividend? Does the Settlement Date Have to Occur Before the Ex-Dividend Date to Receive a Dividend? Does Ex-Dividend Affect Price?

Five key dates every shareholder should know - MoneyWeek Investment TutorialsCan You Buy a Dividend Stock Right Before Pay Date? Does a Stock Drop After a Dividend? Can I Sell Pre-Market on the Ex-Dividend Day?

Record and Ex-Dividend To receive a dividend payment, an investor must own the shares on the declared record date. Owning On Ex-Dividend Date If the stock shares are purchased no later than the day before the ex-dividend date and held until trading starts on the ex-dividend date, the investor will receive the dividend payment. Ex-Dividend Effect On the ex-dividend date, the share price of the stock will start trading at the previous day closing price minus the amount of the dividend.

Selling Considerations Selling shares on the ex-dividend date defeats the purpose of earning the dividend. When Are You Entitled to Stock and Cash Dividends. Popular Articles Does a Stock Drop After a Dividend?

How to Calculate Stock Price After Dividend How to Find a Stock Price on an Exact Day. More Articles Taxes on Stocks After a Death What Is the Effect of a Stock Dividend Declared and Issued Vs.

Substitute Payment in Lieu of Dividends Can You Buy and Sell Stock Options the Same Day? Copyright Leaf Group Ltd.