Covered call option trading strategy

RetireMentors features retirement advice from financial professionals, not staff journalists. Prior to retiring in Dennis ran a successful consulting business and authored several books on sales management. He was also a regular contributor to the American Management Association and an active international lecturer for 40 years. Dennis is featured regularly on several retirement blogs and is a frequent guest on radio shows throughout the country. You can track his exploits at Miller on the Money and on Twitter DMonthemoney , or contact him at milleronthemoney gmail.

There's a low-risk way to boost your retirement income that you might have overlooked: Don't let a possibly unfamiliar investment buzzword scare you off from a frequent moneymaker. Continually learning new investment strategies and refining tried-and-true techniques is a big part of retiring well.

Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it last. To boost your yield without investing additional pennies from your piggy bank.

You can even calculate your profit at the time of the trade. I'll show you how to do it with our options profit calculator in a bit. Mitigating risk is a key tenet of retirement investing, and selling covered calls can help you do that.

A quick note of caution, though. Selling covered calls is hands-down the only type of option trading I recommend for your retirement money — all other options strategies are far too risky for a nest egg that needs to last. A stock option is a right that can be bought and sold. There are two transactions that might occur between a buyer and a seller: The second transaction happens at the buyer's discretion.

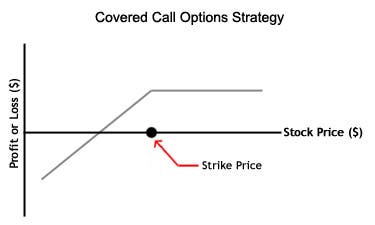

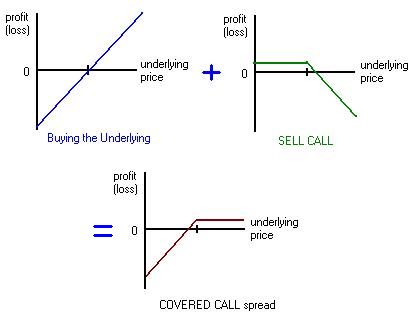

A covered call is one type of option. When selling a covered call, the buyer purchases the right to buy a certain number of shares of stock you own at an agreed-upon price at any time before the option expires. The buyer doesn't have to buy your stock, but he has the right to. Either way, you keep the money you were paid when you sold your option. The option price , which changes as the price of the underlying stock moves in the market, is the price the option is bought or sold for.

As with a stock, there are two prices: A buyer can exercise his option until the expiration date. If that happens — meaning your stock is called away — the shares will automatically be delivered to the buyer, and the cash will appear in your brokerage account. Generally, options expire on the third Friday of every month. So if you're busy making money selling covered calls, who's buying? Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs.

In case you skimmed right past my first warning while reading with tired eyes, I'll repeat it: Now, about those profits.

Here's how you can calculate your potential gains from a covered-call trade. My chief analyst and I built a handy options profit calculator, which you can download here. You'll need to type in some information about your trade in the orange-shaded cells. Here are a few helpful hints for using the calculator.

Covered Calls Explained | Online Option Trading Guide

If your stock gets called away, you'll need to fill in additional information to calculate your gains:. Taxes have a way of finding your profits no matter how you make them.

If you sell a covered call and the option expires, the gain is considered a short-term capital gain, which is currently taxed as ordinary income. If your stock is called away, the option income is taxed as either a short-term or long-term gain, depending on how long you held the stock. Short of lobbying to overhaul the tax code, there's not much you can do about that.

Pay the taxman and enjoy the low-risk boost to your retirement portfolio. Options strategies for your company stock. Selloff is your midterm-election buying opportunity.

Reduce equity risk with structured notes. By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.

Covered Call WritingIntraday data delayed at least 15 minutes or per exchange requirements. Opinion Service industries could use a disrupter like Amazon. A Closer Look at Chris Wray, Trump's Pick to Lead FBI. How to protect your family members — or yourself — from elder abuse. Money CAN buy happiness, if you spend it right.

Forget ping pong, this is the hot new work perk. Updated Uber CEO Travis Kalanick steps down after shareholder revolt. Corrected Oil finishes at a 9-month low, in bear-market territory.

Crude oil losses accelerate, prices slide 0. Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch.

Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last? Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar.

My MarketWatch Watchlist Alerts Games Log In. Retire Mentors Powered by RetireMentors features retirement advice from financial professionals, not staff journalists.

How to Write Covered Calls: 4 Tips for Success | Ally

How to increase retirement income with covered calls. More Coverage This is exactly how much you should tip your Uber driver Saudi Arabia replaces crown prince in major shakeup Oracle earnings: Time for results to match the bluster. We Want to Hear from You Join the conversation Comment.

MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ.