Are stock market returns lognormal

Whether you invest in a single stock, a portfolio of shares or mutual funds made up of stocks, you should be familiar with the fundamental statistical concepts that can help explain the movements of stock prices. Normal and log-normal distributions are two key stat terms you will hear frequently. A basic understanding of these terms will help you grasp how stock prices evolve.

When a variable is normally distributed, its visual representation on a graph will have the familiar bell-curve shape. This means that moderate values have the highest probability of showing up, while extreme values have proportionally lower probabilities of materializing. Assume that bread sales on a typical Monday in a neighborhood grocery are normally distributed, with an average of loaves.

This means that sales levels that are significantly higher or lower than loaves are proportionally less likely. While many variables around you may be normally distributed, a different type of pattern, known as log-normal distribution, may better describe the disbursement of other parameters.

Option Pricing Models (Black-Scholes & Binomial) | Hoadley

Log-normal simply means that the logarithm of the variable is normally distributed. The logarithm of a variable is the exponent to which another number must be raised to produce that number. While the math behind logarithms can get complex, suffice to say that logarithms are most appropriate if the variable at hand has a tendency to grow exponentially when its value is high but move little when its value is depressed.

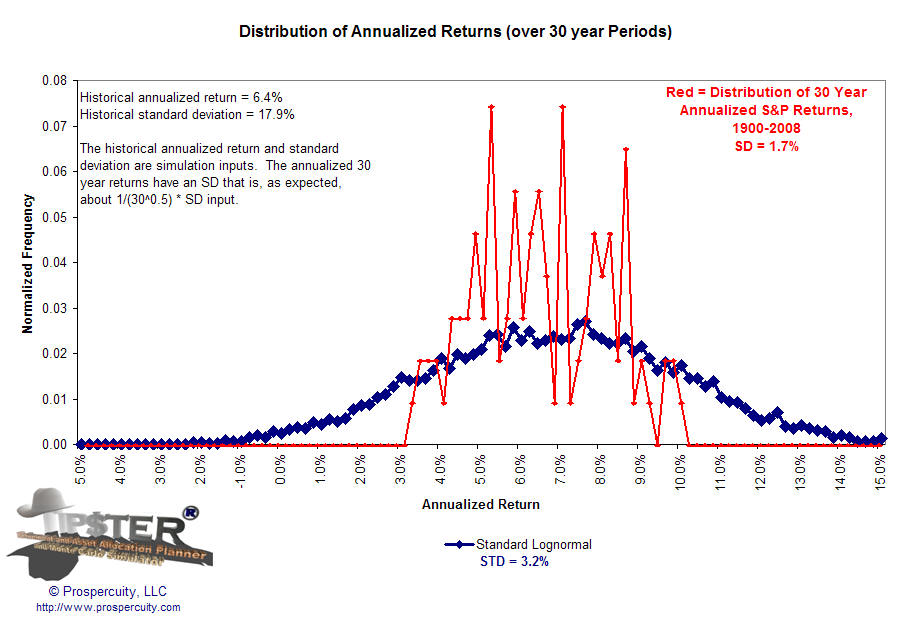

While the returns for stocks usually have a normal distribution, the stock price itself is often log-normally distributed.

This is because extreme moves become less likely as the stock's price approaches zero. Cheap stocks, also known as penny stocks, exhibit few large moves and become stagnant. However, even the few small price changes you will see at these depressed levels correspond to large percentage changes, because the base is so low.

So the stock's return is normally distributed, while the price movements are better explained with a log-normal distribution. The distribution of stock prices and returns will help you determine the probable gains and losses in your portfolio. If most stocks in your portfolio have traditionally exhibited large moves on both the up and the down side, your potential losses as well as gains are large.

Such a portfolio may be suited for a young investor, who has sufficient time until retirement to recover from a significant trading loss.

An investor closer to retirement, on the other hand, may be better off with a portfolio that is less likely to gain or lose very much. Hunkar Ozyasar is the former high-yield bond strategist for Deutsche Bank.

He has been quoted in publications including "Financial Times" and the "Wall Street Journal. He holds a Master of Business Administration from Kellogg Graduate School. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Visit performance for information about the performance numbers displayed above. Skip to main content.

Why Lognormal Distribution is Used to Describe Stock Prices - Finance Train

Why Are Stock Prices Considered Log-normal? More Articles How Speculation Raises Shares How Do Dividends Affect Stock Price? Support and Resistance Levels for Stocks What Is a Moving Average in Stocks? What Is a Stock Market Correction?

Normal Distribution When a variable is normally distributed, its visual representation on a graph will have the familiar bell-curve shape. Logartithm and Log-normality While many variables around you may be normally distributed, a different type of pattern, known as log-normal distribution, may better describe the disbursement of other parameters. Stock Prices While the returns for stocks usually have a normal distribution, the stock price itself is often log-normally distributed.

Implications The distribution of stock prices and returns will help you determine the probable gains and losses in your portfolio. References 3 Wolfram MathWorld: Log Normal Distribution ThinkX Labs: Lognormal Distribution of Stock Prices Princeton University: About the Author Hunkar Ozyasar is the former high-yield bond strategist for Deutsche Bank. Recommended Articles Trend Vs.

Volatility "The Difference Between a Micro Cap, Small Cap and Penny Stock" How Come My Stocks Are Going Up But the Amount I Can Buy on Margin Isn't? Buying on Margin Vs. Money Sense E-newsletter Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

2015 - FRM : The Black-Scholes-Merton Model Part I (of 2)Editor's Picks Should I Use a Mortgage Broker to Refinance? The Basis of Stock Prices What Is the Fourth Phase of a Secular Bear Market?

Why Log Returns | Quantivity

Why Is Open Stock Price Different Than Closed Stock Price? Trending Topics Latest Most Popular More Commentary. Quick Links Services Account Types Premium Services Zacks Rank Research Personal Finance Commentary Education.

urisofod.web.fc2.com - Services & Tools -> Knowledge Base -> Education -> Understanding urisofod.web.fc2.com data

Resources Help About Zacks Disclosure Privacy Policy Performance Site Map. Client Support Contact Us Share Feedback Media Careers Affiliate Advertise. Follow Us Facebook Twitter Linkedin RSS You Tube. Zacks Research is Reported On: Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.

Logo BBB Better Business Bureau. NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.