Tlt put option

iShares Barclays 20 Year Treasury Bond Fund (TLT)

Why Traders Must Watch the Yield Curve. How Stocks, Gold, Bonds, and the Dollar Perform On Fed Days. USO Put Options Volume Erupts as Oil Prices Sink. MY ACCOUNT CONTACT US SEARCH.

ABOUT US NEWS AND ANALYSIS TRADING SERVICES OPTIONS EDUCATION BROKER CENTER 30 FREE TRADES. Stocks quoted in this article: Treasury bonds with a maturity of at least 20 years.

Betting On Yields With TLT Put Options | urisofod.web.fc2.com

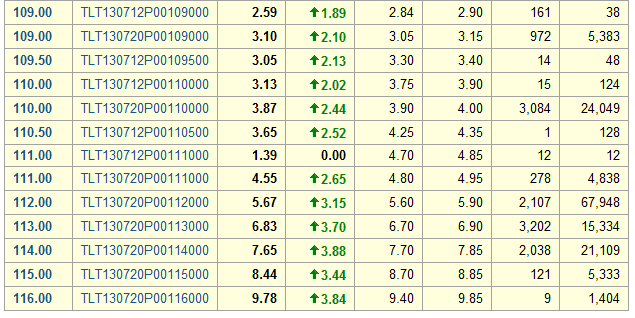

At the International Securities Exchange ISE , Chicago Board Options Exchange CBOE , and NASDAQ OMX PHLX PHLX , 92, calls have been bought to open on TLT shares, compared to 48, puts. In fact, total call open interest on TLT is docked at an annual high, with 1.

Interesting TLT Put And Call Options For July 17th - urisofod.web.fc2.com

As a point of comparison, there are roughly , open TLT puts -- in the middling 44th percentile of its annual range. Simply stated, short-term traders have rarely been as call-skewed as they are now.

Drilling down, the majority of this near-term open interest is focused on out-of-the-money OOTM February strikes. Front-month calls -- which expire at tonight's close -- make up five of TLT's top open interest positions. Looking ahead to the standard March series, TLT's strike put and strike call hold the top open interest positions, with 45, and 39, contracts respectively outstanding.

Losses, meanwhile, are limited to the net debit, as long as the sold put strike remains OOTM.

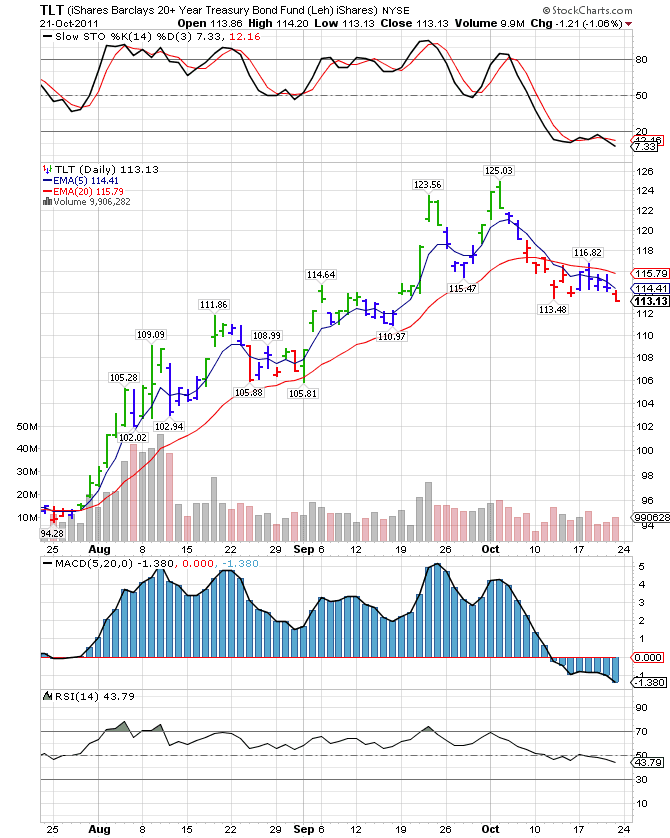

On the charts, bonds sold off sharply in the wake of President Donald Trump's unexpected election win last November. Meanwhile, it's interesting to note that the optimism toward bonds seems relegated to the options pits.

In fact, large speculators on U. Stay in the loop with stocks on the move.

Sign up now for Schaeffer's Midday Market Check. Welcome to Schaeffer's Investment Research! We are a privately held provider of stock and options trading recommendations, options education, and market commentary, headquartered in Cincinnati, Ohio. Founded in by industry pioneer Bernie Schaeffer, we've since become a trusted source of research and analysis for individual investors and major financial media outlets alike.

KEEP READING TLT Why Traders Must Watch the Yield Curve How Stocks, Gold, Bonds, and the Dollar Perform On Fed Days. About Us Trading Services Contact Us Advertise with Us Sitemap Privacy Policy Additional Legal Notice. Unauthorized reproduction of any SIR publication is strictly prohibited.