Stochastics trading strategies

Yen Aims to Extend Gains, Pound Focus Shifts Back to Politics. Gold Prices May Find a Lifeline as Market Mood Darkens. Loonie Slides as Crude Dives- USDCAD Recovery Eyes Resistance. FTSE Further Develops Range on Sharp Turn Lower. Dow Jones Industrial Average Struggles to Hold the Gap Higher. The British Pound Breakdown. Stochastic is a simple momentum oscillator developed by George C.

Be ing a momentum oscillator, Stochastic can help determine when a currency pair is overbought or oversold. Since the oscillator is over 50 years old, it has stood the test of time , which is a large reason why m any traders use it to this day. Slow stochastic is found at the bottom of your chart and is made up of two moving averages. These moving averages are bound between 0 and 10 0.

Ultimate Guide to the Stochastic Oscillator

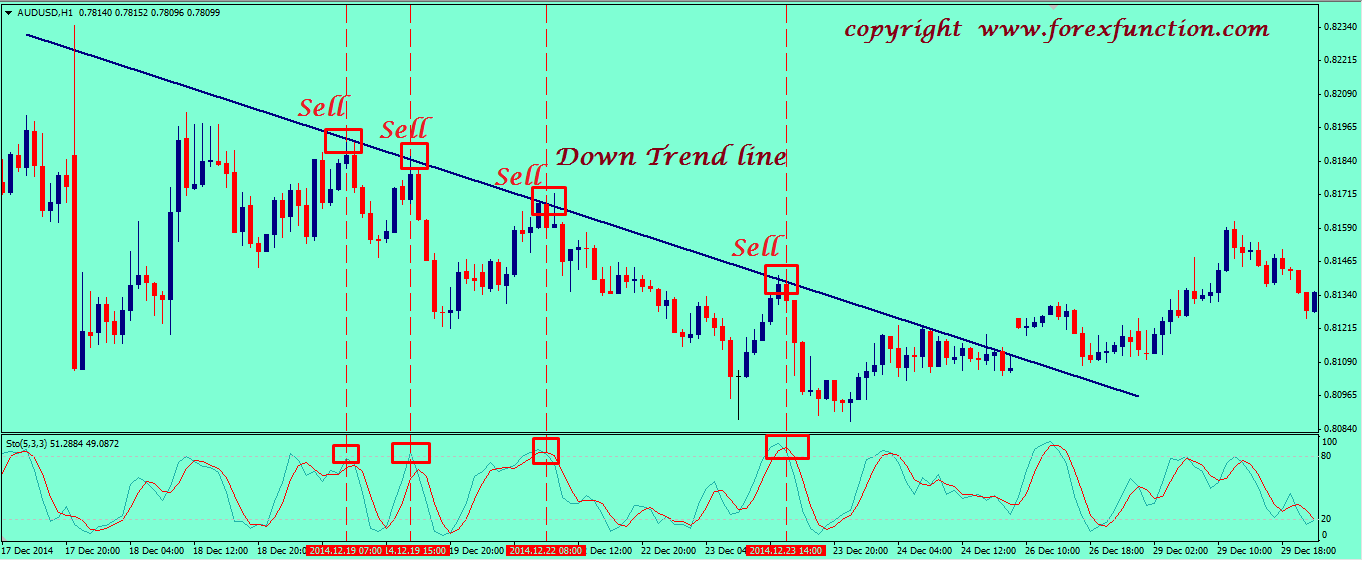

Traders are constantly looking for ways to catch new trends that are developing. As a result, a trader using stochastic can see these shifts in trend o n the ir chart. Momentum shifts directions when these two Stochastic lines cross. Therefore, a trader takes a signal in the direction of the cross when the blue line crosses the red line.

As you can see from the picture above, the short term trends were detected by Stochastic. However, traders are always looking for ways to improve signals so they can be strengthened.

There are two ways we can filter these trades to improve the strength of signal. Some signals are stronger than others. The first filter we can apply to the oscillator is taking cross overs that occur at extreme levels. Since the oscillator is bound between 0 and , overbought is considered above the 80 level. On the other hand, oversold is considered below the 20 level. Therefore, cross downs that occur above 80 would indicate a potential shifting trend lower from overbought levels.

Likewise, a cross up that occurs below 20 would indicate a potential shifting trend higher from oversold levels. The second filter we can look to add is a trend filter. If we find a very strong uptrend, the Stochastic oscillator is likely to remain in overbought levels for an extended period of time giving many false sell signals.

We would not want to sell a strong uptrend since more pips are available in the direction of the trend. Therefore, if we find a strong uptrend, we need to look for a dip or correction to time a buy entry. That means waiting for an intraday chart to correct and show oversold readings. At that point, if Stochastic crosses up from oversold lev els, then the selling pressure and momentum is likely alleviated. This provides us a signal to buy which is in alignment with the larger trend.

Therefore, if we filtered trades according to the trend on a daily chart, then only the long signals green arrows would have been taken.

Therefore, traders us e Stochastic to time entries for trades in the direction of the larger trend. Try it out for yourself. Try it out for yourself in a practice account. Not sure how to manage your risk on a trade? Fast Stochastics vs Slow Stochastics 46 of The Relative Strength Index. Follow me on Twitter at JWagnerFXTrader. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Market News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides.

News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 News getFormatDate 'Mon Jun 19 How to Trade with Stochastic Oscillator getFormatDate 'Wed Jan 22 Swing trading, chart patterns, breakouts, and Elliott wave Connect via: Is it Always a Bad Thing?

Upcoming Events Economic Event.

Stochastic Pop and Drop [ChartSchool]

Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors. CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar.

MACD And Stochastic: A Double-Cross Strategy

EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.