Annuity cash option calculator

Page Description The xx lottery offers jackpot winners the choice of either collecting their winnings as a single lump-sum payout, or as a multi-payment annuity. In xx , the annuity consists of xx payments paid one year apart. Each xx payment xxx. To be fair to the winner, the cash value should be the same as the total required to fund the time-delayed annuity payments.

Both payment values are publicized and paid by the State where the ticket was sold. However, State taxes are not withheld at the time of payment.

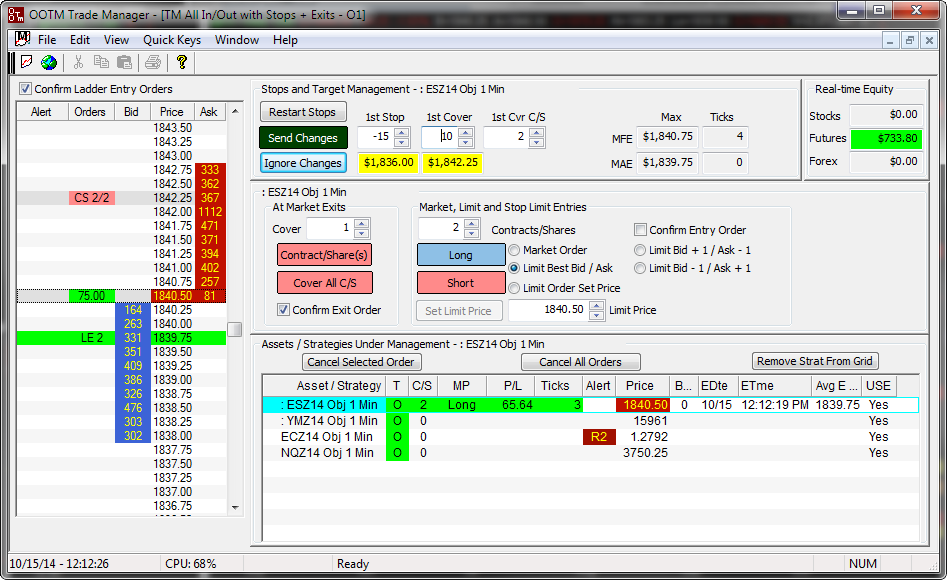

The table on the top right is the lottery information input screen. There, you can change the annuity and cash payouts, yield and ratio, as well as the federal and state tax rates.

Annuity Calculator - CNNMoney

Once you enter your data and either move the cursor or hit return, the corresponding payout structure and tax summary tables will be updated automatically. The table on the left illustrates each of the individual annuity cash payments. And, the table on the bottom right shows the tax implications based on both federal and state rates. Table T1 above shows each of the individual cashflow payments that will be made by xx annuity.

The full amount of the yearly payment from this, you will pay taxes Fed Tax: The amount of Federal tax due for that payment. The amount of state tax due Net Payment: The amount of money you will keep after taxes.

The implied yield required to fund this payment Discount Price: The amount of money that needs to be deposited to fund this payment At the bottom of the table, all values are totaled except yield because this does not apply.

The total sum of the payments will be equal to the annuity jackpot value.

Financial Calculator Part 3 - AnnuitiesAnd, the total sum of the discounted prices will be equal to the advertised cash value. All items that are important to the lottery jackpot winner. However, particular attention should be paid to the Fed and State Tax totals, and the Net Payment total because this is the amount of money you will keep.

Mega Millions

This section allows you to enter the Annuity, Cash, Yield and Ratio values in the column labeled 'Value'. These are shown in green. In addition, you can select your Federal Tax filing status and State of residence.

Detailed Help for Table T2. This Tax Summary table shows you how much money you will receive and pay, depending on whether you opt to take the Cash or Annuity payouts. Table T3 Detailed Help.

Links Lottery Players and Winners: Estate Planning for the Optimistic and the Lucky Advising a Client Who Has Won the Lottery. Typically, you would enter both the Annuity and Cash values since these are given , and then the Yield and Ratio values are calculated accordingly. However, to make it easier to use, you can select any parameter to hold as a constant 'Hold' column.

For example, if you change the Annuity hold value to Ratio, then that value will remain constant whenever you change the Annuity value and so on.

Taxes are calculated using the Federal and State Tax Tables, which means that the amounts of tax due will vary depending on the amount of payment you receive. You may change your filing status from 'Joint' to 'Single' row 4 , which will determine both your Federal and State Tax amounts. Lastly, you can change your State using the pulldown in row 5.

Lottery Calculators - AfterLotto

The Tax Summary table shows you how much money you will receive and pay, depending on whether you opt to take the Cash or Annuity payouts.

The values displayed under the first 2 columns are: How much federal taxes you will pay. How much state taxes you will pay. The amount of money you will keep. Note that whenever you change the Federal filing status or State Table T2 , all values except Gross will change accordingly.